AI Statistic

Financial Statement HDFA

| Tanggal Buy | Buy | Tanggal Sell | Sell | Status |

|---|---|---|---|---|

| 12/12/2025 | 138 | 12/19/2025 | 142 | +2.90% |

| 09/19/2025 | 126 | 09/30/2025 | 148 | +17.46% |

| 04/09/2025 | 99 | 09/16/2025 | 127 | +28.28% |

| 02/13/2025 | 109 | 03/12/2025 | 105 | -3.67% |

| 01/03/2025 | 117 | 01/15/2025 | 116 | -0.85% |

| 09/10/2024 | 116 | 12/02/2024 | 144 | +24.14% |

| 07/04/2024 | 88 | 09/02/2024 | 130 | +47.73% |

| 06/26/2024 | 88 | 06/28/2024 | 94 | +6.82% |

| 05/29/2024 | 90 | 06/10/2024 | 89 | -1.11% |

| 04/29/2024 | 92 | 05/13/2024 | 91 | -1.09% |

| 02/27/2024 | 99 | 03/18/2024 | 97 | -2.02% |

News

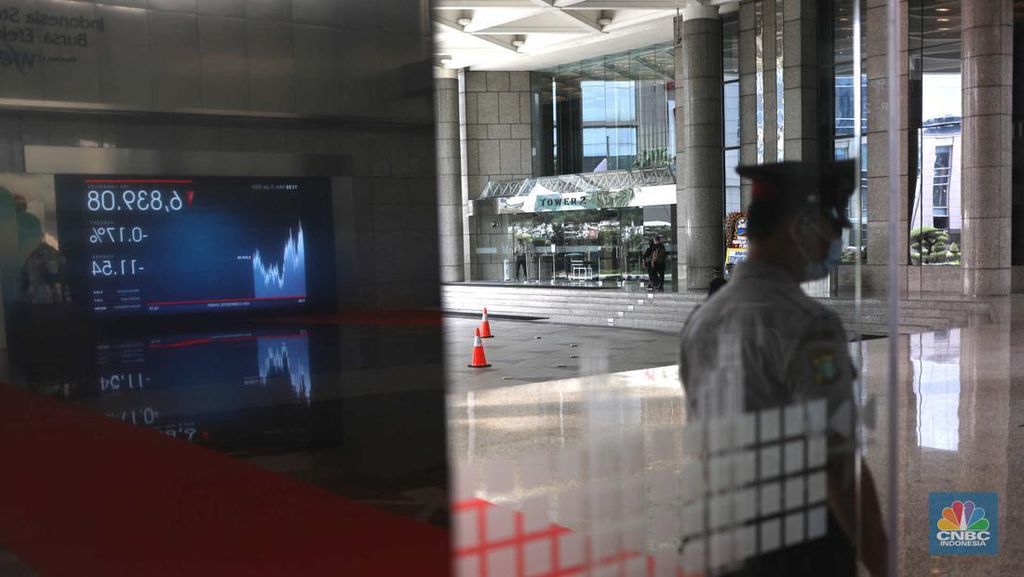

IHSG Belum Lelah, Dibuka Kuat dan Dekati Level 7.800-an

Sumber: CNBC Indonesia - 11/09/2024

Bursa Asia Dibuka di Zona Merah, Pasar Tunggu Data Penting

Sumber: CNBC Indonesia - 28/08/2024

Dibuka Menguat Tipis, IHSG Bergerak Galau!

Sumber: CNBC Indonesia - 28/08/2024

Naik-Turun Ala Ketua The Fed yang Bikin Dunia Cerah Lagi

Sumber: CNBC Indonesia - 08/02/2023

Naga-naganya IHSG Bakal Lanjut Ijo Hari Ini NIh

Sumber: CNBC Indonesia - 08/02/2023

Ada Kabar Baik dari AS, Bursa Asia Juga Cenderung Cerah

Sumber: CNBC Indonesia - 08/02/2023

Powell Tak Lagi Risaukan Pasar, IHSG Cuma Naik Tipis

Sumber: CNBC Indonesia - 08/02/2023

Feeds

AI Teknikal:

Arvita: AI Expert Analyst

Analisa dari AI Arvita berdasarkan pergerakan harga saham terupdate. *Disclaimer ON.

"HDFA berada diatas MA200 Daily (125), EPS growth = (187%), Price earning Ratio = (-311) dan Book value per share = (87), ideal untuk investasi."

"HDFA : Dalam 5 hari terakhir asing melakukan Net Akumulasi dengan net value sebesar 0 Miliar."